Report: Disney’s Shift Of ‘Moana 2’ Production To Canada Cost California Hundreds Of Millions In Economic Benefit

The Walt Disney Company’s decision to produce most of Moana 2 in Vancouver instead of Los Angeles was a costly blow to the L.A. animation industry, and now, a must-read report has put a dollar amount on the losses to California’s economy.

If the film had been made in California, like the original Moana in 2016, it would have supported 817 jobs (338 jobs directly supported by the production and 479 jobs supported in other industries), created $87 million in employee earnings, and contributed $178 million to the state’s overall gross domestic product.

The new report released today, titled “Reclaiming California’s Role in Global Animation” (downloaded PDF), warned that California’s animation industry is on the brink and that without new incentives that are competitive with other states and countries, the state’s entire animation industry could collapse. The report by CVL Economics was commissioned by The Animation Guild, Titmouse Foundation, and Bric Foundation, with support from other California animation companies and organizations.

The timing of the study is not coincidental, as California politicians are currently considering the creation of an animation tax credit (Assembly Bill 1138 and Senate Bill 630) that would make the state more competitive with other animation production hubs which offer similar credits and rebates.

It underscores that California is no longer a competitive location for producing animation, and says that the state is “now decades behind the aggressive policy strategies implemented by global competitors.”

Animation Guild president Jeanette Moreno, who has visited California lawmakers in Sacramento in recent months to lobby for incentives, said in a statement: “Behind every animated show or movie are thousands of artists, writers, and technicians who make the magic happen — and they’re being left behind. Our members are ready to work, but without competitive tax incentives, those jobs are going elsewhere. This report shows just how urgently California needs to act to protect its animation workforce and remain a global leader.”

Distressingly, pre- and post-production jobs, which were once considered safe jobs in Los Angeles, are now being outsourced overseas, which the report explains is “putting the entire production chain at risk.” One such example was provided in the report:

Krapopolis at Bento Box Entertainment outsourced to Ireland and Australia. Design work including background paint and color design was done through Ireland, while animation and retake animation was done by a team in Australia. Several union staff members were directly affected through layoffs to make this happen.

Alison Mann, president of Fourth Wall Animation talent repping agency and co-founder of BRIC Foundation, commented on the dire strait of animation employment in California. “Most of my creatives have been out of work for over a year,” she said. “Some of my most talented storyboard artists and directors have had to take unrelated jobs at places like Lowe’s just to make ends meet. Meanwhile, my international clients, who benefit from more robust government funding and incentives, continue to successfully launch independent features.”

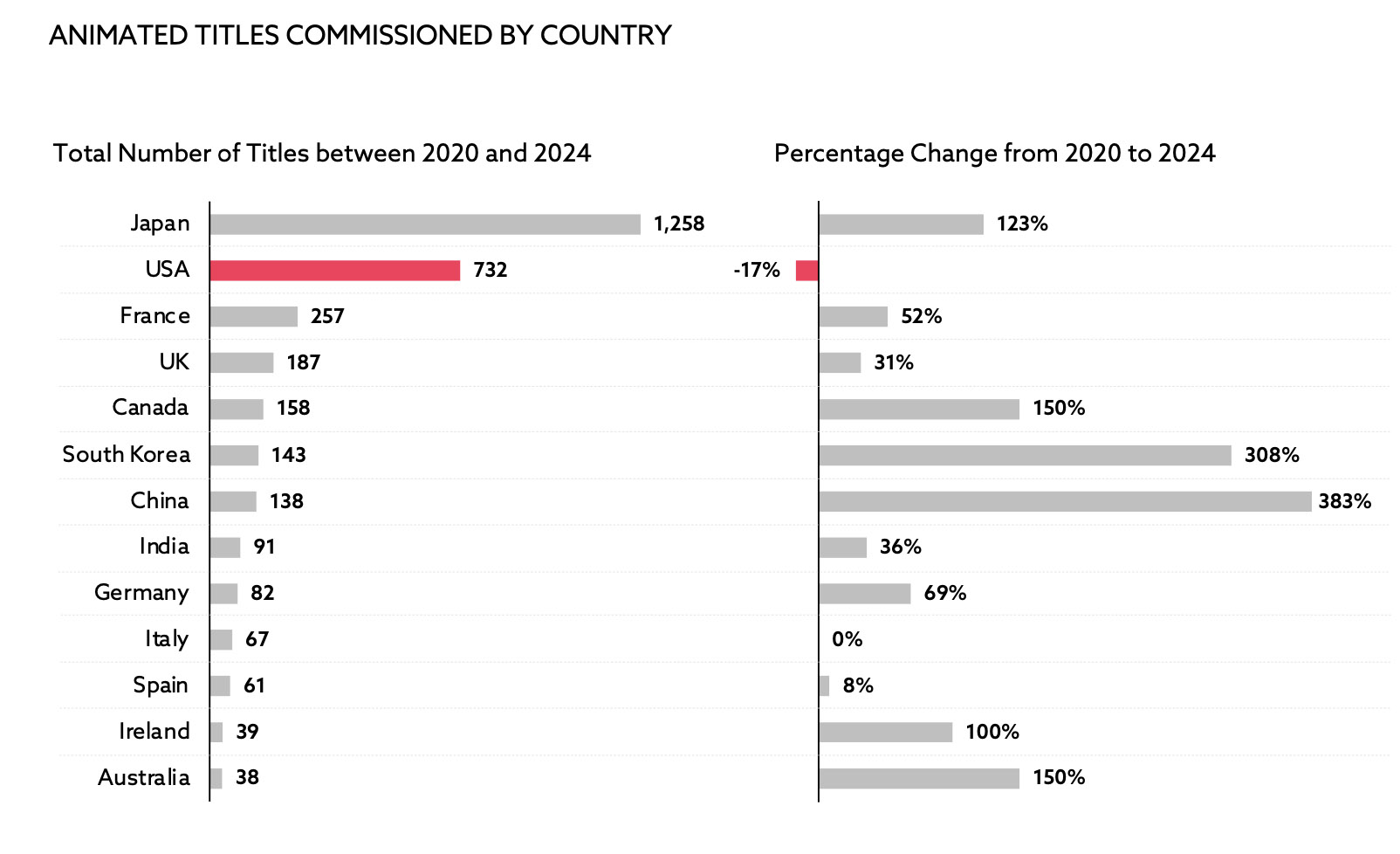

California has a lot of catching up to do as foreign governments continue to invest heavily in their animation industries. The report offers data on the booming global animation industry, projecting that the global animation market will more than double over the next decade, from $413 billion in 2024 to $896 billion in 2034. Yet, even as animation production is surging, the U.S. is the only major animation producing country that is commissioning less content over the last five years.

Other key findings from the study:

- California is losing ground. Thirty U.S. states and nearly every major global hub now offer tax credits for animation. California does not — despite being the birthplace of the industry.

- Post-production collapse. Since Canada introduced its film tax credit in 1995, California’s post-production workforce has shrunk by nearly 60%.

- High-value work is fleeing. Animation jobs in California have declined 4.7% since 2019, while British Columbia’s have surged +72% due to aggressive incentive policies.

- Global market, local losses. Animation is a $400 billion industry powering streaming, gaming, VFX, and virtual production. As global demand grows, California’s market share continues to fall.

The report gives the following policy recommendations to help stabilize California’s animation industry:

- Level the playing field: Make animation and VFX fully eligible for tax credits — as done in New York, Georgia, British Columbia, and across Europe.

- Keep post-production local: Eliminate per-project caps on in-state VFX spending to protect and grow high-wage jobs.

- Carve out space for animation: Create a dedicated allocation within California’s $750M film tax credit so animation isn’t crowded out by live-action productions.

.png)